Copart – A monopoly in a duopoly market - part One

Overview

Copart, founded in 1982 by Wills Johnson, is a dominant player in the salvage auto auction industry, handling over 3 million transactions annually. From its humble beginnings in California, the company expanded rapidly in its early days, going public in 1994 after its largest competitor, Insurance Auto Auctions (IAA), planned to go public (it is important to note that IAA was a more dominant player than Copart at the time of both companies IPO). The company's early adoption of technology, as seen in the transition to online-only auctions in 2003, has cemented its position as the leader in salvage auto auctions. Today, the company operates in eleven countries, which include the U.S., Canada, the UK, Brazil, Ireland, Germany, Finland, the UAE, Oman, Bahrain, and Spain.

What it does

Copart typically sells salvaged vehicles, but it has expanded its range of products to wholesale cars and industrial equipment. Around 80% of the vehicles Copart sells come from insurance companies that have been declared a total loss after it has been in an accident. The other 20%, which includes whole cars, comes from auto dealers, finance companies’ charities and individuals.

The company has tried to grow its non-insurance business by launching ventures like the Blue Car group. This group includes volumes from finance companies and rental car companies. Copart also offers dealer-centric remarketing services through Copart dealer services. Additionally, Copart buys vehicles from the general public under the brand name of Copart Direct.

Buyers of a vehicle listed on Copart’s website include vehicle dismantlers that sell off the valuable parts (Copart believes this is the largest group of buyers based on volumes), rebuilders, used car dealers (used car dealers tend to buy vehicles that were stolen but recovered or slightly damaged cars) and exporters that repair the vehicle to drivable standards in their countries (standards are usually lower in other parts of the world). The company’s platform attracts buyers from more than 190 countries, with Mexico being one of the largest. These international buyers impact 90% of the bidding activity on the platform and collectively purchase around 30% of the vehicles sold on the platform. Although Copart attracts a large base of international buyers, revenue generated is recorded as domestic revenue, even if the buyer is from another region.

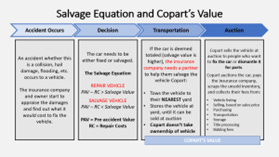

Copart's job is to make insurance companies' lives easier by providing a full range of services that minimise cost and maximise the sale price of a vehicle. When a car is first involved in an accident, it is typically towed to a storage facility or a collision repair shop, where it can then be inspected by an adjuster from the policyholder’s insurance company. The adjuster estimates the costs for repair, and the insurance company determines whether to pay for repairs or to classify the car as a total loss and write the policyholder a check. Copart does offer a service called ProQoute, which helps insurance companies determine if a vehicle should be repaired or deemed a total loss by providing salvage value estimates. A vehicle is considered a total loss when the cost to repair it exceeds a certain threshold of its pre-accident value (PAV), often around 70-75% (refer to the “Revenue impact and future growth” section for more detail on PAV).

It might sound decent at first, but I have a hard time focusing on the job requirements when I feel that so many of these cars could easily be saved. My job is to KILL cars. For example, any older car that gets a light hit that requires a handful of parts and paint labor? It goes to the scrap yard in a hurry. The formula is simple: Get the value for the car, write a damage estimate, add 30% for potential supplementary repairs, get a bid on the salvage selling price and then do the math. If the value is higher than those three combined, it gets repaired.

(Source: The Auto Pain) (Job of an insurance adjuster)

When a car is declared a total loss, it is towed to the nearest Copart salvage yard, where it can be stored until it is auctioned. In some states, Copart needs to clear the title of the car and convert it into a salvage title with the local DMV before it can be sold (it does not take ownership of the car). This process will typically take 45-60 days, which means the car would be at a Copart yard for up to 60 days before it can be sold. Advanced charges, such as the cost to release a vehicle from an impound yard, are paid upfront by Copart, and recovered once the vehicle is sold by invoicing the seller or deducting the proceeds due to the seller.

The settlement process following a car being declared a total loss or written off is similar globally. In most cases, the policyholder receives the car's PAV. However, in some countries, the policyholder may be offered a settlement instead of the PAV or the difference between the salvage value and the PAV.

Along with selling cars, Copart also offers power sports vehicles and heavy machinery. However, these represent a small percentage of the total volume.

The company uses virtual bidding three (VB3) technology to help auction vehicles. This technology employs a two-step bidding process. The first step is an open preliminary bidding feature that allows members to enter bids online or at a storage facility's bidding station during the preview period. Members enter the maximum price they are willing to pay for a vehicle, and VB3’s BID4U feature incrementally bids on the vehicle on their behalf during all phases of the auction. Preliminary bidding ends at a specified time before the start of a second bidding step, an internet-only virtual auction. This second step allows bidders to bid against each other and the high preliminary bidder. The bidders enter online bids in real-time while BID4U submits bids for the high preliminary bidder up to their maximum bid. When the bidding stops, a countdown is initiated. If no bids are received during the countdown, the vehicle is sold to the highest bidder.

Revenue Breakdown

Copart's revenue is divided into two main areas: service revenue and vehicle sales. Service revenue includes auction and auction-related sales transaction fees for vehicle remarketing services. These fees are based on a percentage of the item sold or a fixed fee for each item, as well as transportation fees, bidding fees, title processing fees, and other related fees. Service revenue is the largest segment for Copart, and the company charges fees to buyers and sellers, with most of the fees coming from buyers. The fees from buyers are based on the item's selling price, with lower percentage fees for higher-priced items (buyers may be charged 20% or higher of the selling price as a fee). Additionally, Copart earns at least 6% of the total vehicle sale price from the sellers. Sales under the Consignment and Percentage Incentive Programs (PIP) are categorised under service revenue.

Vehicle sales revenue includes selling a vehicle Copart has purchased or considered owning. A large part of the revenue comes from international markets, such as the UK and Germany, as Copart buys vehicles from insurance companies and sells them on their account. This is not an attractive model for selling salvage vehicles for both the insurance company that is selling the vehicle and Copart because Copart first needs to buy the vehicle from the insurance company at the lowest price possible. Copart then needs to sell a vehicle for as high as possible to make a profit. Copart also requires a large amount of working capital to buy vehicles and resell them continually (this is also a lower-margin segment). This is referred to as the principal model.

The consignment model involves an insurance company entrusting salvage auction companies to sell the vehicle instead of buying it from them. The auction company handles the sale process, including marketing, bidding, and transaction management. Once the vehicle is sold, the auction company takes a fixed fee or a percentage of the final sale price from the sale proceeds, and the remaining amount is paid to the insurance company. This model also frees up Copart’s balance sheet as the company does not need to buy salvage vehicles from the insurance companies.

PIP is a business model where auction companies like Copart earn a commission based on a percentage of the vehicle’s final sale price. This is similar to the consignment model, as the insurance company entrusts the auction company to sell the vehicle for them. Compared to the consignment model, the differentiating feature is that Copart will offer extra services as part of this model, such as cleaning the car (refer to the next paragraph for the services provided by Copart). This model aligns with the interests of the auction and insurance companies, as both benefit from higher sale prices. PIP often results in better marketing and more competitive auctions by incentivising the auction company to maximise vehicle values – cleaning the car before selling it is one way to maximise the value. This approach can lead to higher returns for insurers and more efficient operations, fostering a mutually beneficial relationship.

Additional services Copart offers include covering or taping openings to protect vehicle interiors from weather, washing vehicle exteriors, vacuuming vehicle interiors, cleaning and polishing dashboards and tyres, making keys for driveable vehicles, and identifying driveable vehicles. These services can lead to higher returns for both the seller and Copart.

When Copart first entered the UK market, the insurance landscape differed significantly from the US. UK insurers were initially unfamiliar with the consignment model and PIP. Consequently, Copart adopted the principal model to establish its presence. To encourage the shift to the consignment model/PIP, Copart built its network of yards out and collected and analysed UK market data to demonstrate the benefits of the consignment model/PIP and the returns the insurance company could receive from using Copart services. Their efforts paid off, convincing insurers of its benefits. Today, Copart sells over 300,000 units annually in the UK, primarily through the consignment model/PIP, positioning it as a leading market player (it is estimated the company has the most market share in the UK with no real competitor).

It is interesting to note that the company was making more money using the principal model in the UK. In this model, they bought cars from insurers, refurbished them, and resold them. However, they switched to the consignment/PIP model because the company understood that the principal model carries more risk when used car prices drop. The company also switched because the consignment/PIP model is fair for both parties and puts them on the same side of the table. This demonstrates the company's governance is good, as short-term profits do not blind them.

After success in the UK market, Copart is trying to export its blueprint to the European market. Copart believes it is as big as the US and has similar characteristics, such as the age of the vehicle fleet and high labour rates (Refer to “How revenue and profits can be impacted/ growth trends” for information on the US market). It is important to note that Copart will only expand into a market if it believes its model works.

Copart has been working to expand into Germany, a market distinct from the US. In the US, when a car is totalled, the insurance company takes ownership of the vehicle from the policyholder. In Germany, however, the vehicle owner retains ownership of the vehicle post-accident, receiving compensation for the difference between the PAV and the post-accident value (the consumer keeps the car). The insurer auctions the damaged vehicle, giving the owner 21 days to accept the offer, or the policyholder can sell to a third party. This results in lower bids from auction winners, as their capital can be tied up for a long time, and the owner may receive a higher price from a third-party sale (the auction winner is not guaranteed to get the car, even if they win the auction)

With Copart entering the German market, the company has established a network of yards and trucks to streamline operations. Copart directly approaches insurance companies and policyholders, offering the PAV to acquire vehicles. These vehicles are then refurbished and sold on Copart's platform, accessible to an extensive network of international buyers. By doing this multiple times, Copart has built a robust database to showcase the potential returns insurers can achieve by partnering with Copart using the Consignment model. This strategy has been successful, as Copart is now selling on a consignment basis for most of Germany's top ten insurance carriers.

The company is also in the Spanish and Finish markets. The Finish market is similar to the US market, so the company does not need to do much work to convince insurers to change their model. However, the Spanish market is similar to the German market, and the company has followed the exact blueprint.

The company is a significant player in the UAE, although the UAE is not a large market. It has also begun expanding into Brazil. Most of the company's growth is expected to come from the international market, as it is already an established player in the US. It will be challenging for the company to keep taking market share from its competitors in the US, as it has done in the past (refer to the “Competition” section for more details on market share in the US).

The company also entered the Indian market at one point but pulled out because it was too bureaucratic and fragmented. The Indian market also worked very differently from what they were familiar with. This is an excellent example of good governance within the company as it demonstrates that it is not afraid to pull out of a project if it sees something is not going well.

The US is a higher-margin region for the company because of its more extensive scale and the service segment representing a more significant part of total revenue. As the company expands internationally and insurers adopt the consignment model/PIP, its margins should align with US margins (some new markets, like Brazil, are already on the consignment model).

The company can facilitate the transition of European insurers to the consignment model/PIP more quickly, as they already have successful examples in Germany and the UK. It may take some time for emerging market nations, such as Brazil, to become a more significant part of the company, as they have lower car ownership per capita, and some countries do not even have car insurance. The company sees the emerging market as a long-term investment, as it is waiting for these economies to develop.

Revenue impact and future growth

Copart revenue can be impacted by several factors, such as the total loss frequency and the average selling price of a vehicle sold on Copart’s platform. Total loss frequency refers to the percentage of insured vehicles involved in an accident declared a total loss by insurance companies within a given period. A vehicle is considered a total loss when the cost to repair it exceeds a certain threshold of its pre-accident value (PAV), often around 70-75%. A higher total loss frequency indicates that more cars involved in an accident are being written off instead of repaired.

The total loss ratio has increased over the past 30 years due to changes in used car prices and repair costs. The total loss ratio in the US is 20.9%, above the pre-pandemic high of 20%. The trend continues as repair costs and the average age of cars on the road increase, with the total loss ratio potentially reaching over 30% in the long term (already at 30% for a few data-driven insurers).

As for your question about where total loss frequency would -- can it exceed 30%? I think the answer is affirmatively yes. The economic value -- meaning, some carriers are there today, and others as used car values will -- even as used car values stabilize, repair costs divided by the value of cars has increased monotonically forever, and we expect that to continue as well.

(Source: 2Q24 earnings)

The average age of cars has increased from 9.7 years in 2003 to 12.5 years in 2023. As a car's average age increases, its PAV decreases, which makes it more likely that the car will be declared a total loss due to the costs of repair as a percentage of PAV exceeding its threshold. According to Copart, a vehicle seven years or older is 2.5 times more likely to be salvaged than a vehicle six years or newer.

As cars have become more complex and repair costs have gone up, the total loss ratio has increased due to insurers declaring cars a total loss as the cost to repair a vehicle as a percentage of PAV exceeds the threshold that insurers look at before declaring a vehicle a total loss. The addition of sensors and other technological features in a car has made it so that when a vehicle is involved in a minor accident that scratches the car, it could be deemed a total loss as it is costly to repair the tech in a car.

Driver assistance technology became mainstream in 2016. This technology alone adds 38% to the total cost of repairing a car. The trend of new car technology will continue, leading to a higher total loss ratio.