Constellation Software- A M&A Machine

Introduction

Constellation Software (CSU) is a Canadian serial acquirer that targets Vertical market software businesses. A vertical market software (VMS) is a niche software that is made for a specific industry. The software used in the Bloomberg Terminal is a great example of vertical market software, made specifically for the finance industry. On the other hand, Microsoft Word is a great example of Horizontal software as it can be used by any individual in any industry.

The company serves over 125 sub-industries, including public and private companies. The primary geographic location CSU operates in is North America (59% of revenue), Europe (19% of revenue), and the UK (8% of revenue).

There is typically not a lot of competition in Vertical markets, but it can still be risky since developers rely on specific clients to buy their products. With CSU, no client contributes more than 5% of the revenue earned by the company. CSU's software is crucial for its clients and is often considered a last resort to cut during tough times. The cost of CSU's software is relatively small compared to other expenses for its clients. CSU's customer relationship management is one of its biggest advantages, especially in certain industries where the company has maintained decades-long relationships with some of its clients. Below is a quote from the CEO, Mark Leonard, where he describes the moat of CSU.

"And the moat around our businesses is different than the moat around our acquisition engine. The moat around our businesses, as you would expect, it's the stickiness of the software, it's relatively limited number of competitors in each one of the verticals, it's a intimate knowledge of their needs and being able to deliver to those highly targeted verticals, very customized solutions, which is the opposite of the sort of thing that you hear in a lot of software companies where it's economies of scale and being a low cost provider, and then eventually, once you've driven everyone else into bankruptcy, gradually jacking up the prices, which appears to have been $1 trillion trick.

And so those moats, I feel pretty comfortable about -- we haven't seen a lot of instances where those moats have been crossed effectively and where economic value has been destroyed in the portfolio companies. The moat around the acquisition engine, the ability to buy lots of small medium-sized companies with attractive rates and return on the deployed capital is a lot harder to define. And as I tried to think it through and figure out how to make it deeper and harder for people to cross, what I discovered was a lot of it was know-how and learning curve. And the problem with those things is that they travel in the years of employees. And so employees can leave and they can take a lot of that with you. And so what you have to do is sort of race up that learning curve as fast as you can and constantly improving. So the constant incremental improvement of M&A for small and medium-sized businesses is our competitive advantage."

(Mark Leonard on the moats of the VMS businesses and the acquisition machine)

Large tech companies like Google and Amazon have no presence in the wider VMS industry, as most of the industry is too small to make a significant contribution to its earnings. As a result, competition tends to come from smaller, less sophisticated and more cash-constrained software companies in the vertices CSU competes. With the lack of competition, CSU still spends capital on R&D to continue improving its products.

One downside of VMS is the total addressable market (TAM) tends to be small compared to a company selling horizontal market software (HMS). Unlike a HMS, A VMS is tailored to one niche, and one niche only. Intuit's accounting software can only be used for people that need help with their taxes, it is useless for anyone outside this group.

Deep dive into its Segments

CSU has several main operating segments, including software licenses, professional services, hardware, and maintenance. Software licenses consist of non-recurring fees for licensing, while professional services include fees for implementation, custom programming, and product training. The maintenance segment generates recurring revenue, including fees for software support. The hardware segment generates revenue by selling tailored hardware.

In 2022, the company generated the company saw growth in revenue from software licenses, which increased from $287 million to $320 million in 2022. This accounts for 4.62% of the total revenue generated. Professional services also experienced growth, with revenue increasing from $1033 million to $1381 million, representing 20.85% of the total revenue. Hardware sales revenue also grew, increasing from $176 million to $233 million, accounting for 3.52% of the total revenue. The revenue from maintenance also saw an increase, growing from $3611 million to $4688 million, representing 70.79% of the total revenue.

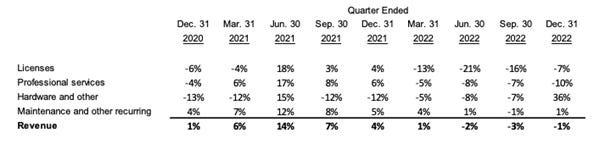

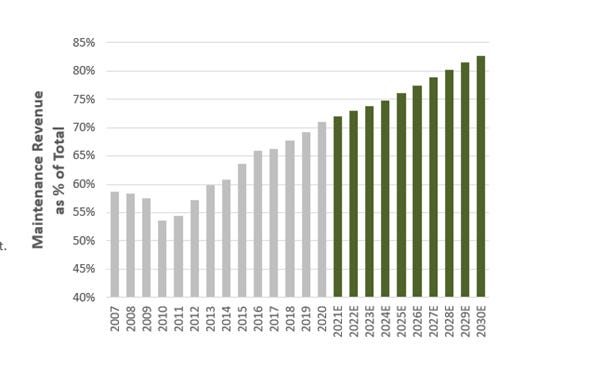

The revenue earned from maintenance services is of high quality as it is recurring. This is evident from Chart A, which shows that maintenance revenue has low and stable organic growth. This is good news for CSU as the majority of its revenue comes from maintenance services. Table A indicates that the percentage of maintenance revenue as a part of the total revenue has been increasing and is expected to continue to do so, as per the estimates from the 10th man. The maintenance segment has been one of the fastest-growing segments for the past decade and will continue to grow in importance, reducing the drag from other categories.

(Source: CSU Financial statements report)

(Chart A, Source: The 10th man)

Inside Mark Leonard's mind

Mark Leonard is the founder and CEO of the company. Before founding CSU, Mark worked in the venture capital business. Mark sees himself as a partner of the business rather than an employee, hence he doesn't receive a salary and is responsible for all travel-related expenses.

CSU is a company that frequently acquires others, so it's atypical that they would offer a dividend since they usually use their capital for mergers and acquisitions. However, according to Mark, the decision to offer a dividend was a clever choice because it made CSU stock more appealing to a wider audience, which ultimately helped private equity investors exit. He believes eliminating the dividend would disenfranchise a group of shareholders- although, in 2021, Mark mentioned that the dividend would be cut if a good opportunity presented itself. Excluding 2019, a year in which the company paid a special dividend, CSU has used about 10% of its adjusted free cash flow on paying a dividend.

Mark discusses his business philosophy in his shareholder letters, sharing similar views to Warren Buffett. Mark does have a different perspective on buybacks compared to Warren Buffet. Mark is not a fan of buybacks because he believes they often lead to insider selling by increasing the short-term share price. Like Berkshire Hathaway, Mark aims to attract long-term shareholders and does not want to attract short-term shareholders through a buyback program. Performing buybacks could result in CSU losing its competitive advantage, as directors and officers are legally prohibited from doing buybacks while in possession of material undisclosed information. Although Mark does not reveal the techniques that generate the most M&A opportunities, if CSU proceeds with buybacks, such information could become public.

The company is split into 6 operating groups and each operating group manager has full autonomy to acquire any new vertical market software business under $20 million unless certain criteria are met for acquisitions between $20 million and $50 million. The remaining cash flow is sent to the head office. The head office uses this cash to acquire more VMS businesses or pay dividends to shareholders. Early on in CSUs history, Mark Leonard and the head office were the main decision-makers on what types of businesses to acquire, but as the company got bigger, Mark pushed down the responsibility of M&A sourcing to operating group managers. The head office retained the authority to approve any acquisitions but eventually, CSU later gave the discretion to the operating group heads to approve mergers and acquisitions of up to $20 million. By pushing down responsibility, it shows Mark trusts CSU employees will follow the culture that has been created.

The Operating Groups

As mentioned above, there are 6 operating groups. In every operating group, there are dozens of business units. As the operating groups have grown, Business unit managers have also been responsible for acquiring new businesses. Operating group and business unit managers try to maximise the growth opportunities, profitability, and return on invested capital (ROIC) within their business.

Volaris is the first operating group that makes up the CSU group. The primary geographic location the group operates in is the Americas, Europe, Australia, and Africa. This group serves a wide range of industries, including the Education and Asset Management industry. The second and third operating groups are Harris and Jonas, respectively. The primary geographic locations covered by these groups are North America, Europe, and Australia. Harris caters to industries like healthcare and utilities, while Jonas caters to construction and payment processing industries. Vela is the fourth operating group, serving industries such as manufacturing and travel. It primarily operates in the Americas, Europe, and Australia. Perseus is the fifth operating group, serving industries such as homebuilders and dealerships. It primarily operates in North America and the UK. Topicus.com is the final operating group, serving industries such as finance and retail. It primarily operates in Europe and the UK.

Each of the Company's operating segments functions as a mini-Constellation Software, comprising small vertical-market software companies with similar economic characteristics. The CEO of each operating segment is dedicated to investing capital in a way that generates returns at or above the investment hurdle rates set by CSI's head office (primarily the President) and the Board of Directors, regardless of whether the acquired business operates primarily in the public or private sector. As mentioned above, operating group managers have the authority to approve most purchases made by CSU. This has resulted in the transformation of these groups into mini-CSU entities. These operating groups are now getting to a size where they can't do all the M&A so they are pushing down that responsibility to the portfolio/ business unit managers that are reporting to the operating group managers. In the same way that the head office originally retained the authority to approve acquisitions, the operating group heads retained the authority to approve most of these acquisitions. Over time that will likely change, and you will have something like 50 mini-CSUs. The managers of each business unit are usually experts in a particular field. This specialization allows them to gain a deeper understanding of customers, competitors, and products. These business unit managers even tend to source deals for CSU as they tend to be well-connected in their specific niche. CSU competitors, like Private Equity (PE) groups, tend to be generalists, which is a disadvantage.

The M&A strategy

CSU typically acquires good companies, but occasionally they purchase an exceptional one. They look for companies with high ROIC and growth potential, and while they don't have to be a leader in their niche, they must have the potential to become one, while also having a diverse customer base. Additionally, CSU seeks out companies with capital-constrained competitors. While they rarely acquire companies with different characteristics, they may do so if they believe they can achieve attractive returns through customer relationship management and market segmentation. CSU's approach to acquiring companies differs from that of private equity groups in that it prioritizes long-term focus instead of exit strategies. Mark, the founder, has only sold one VMS business in the past due to a high offer but regrets the decision to this day.

CSU describes an exceptional company as having consistent profitability, above-average growth and an outstanding manager. These types of companies trust CSU to continue operating according to the history and values that made them exceptional in the first place, which is why they want to sell to CSU. According to CSU, a good company has hundreds, or even thousands, of customers, faces minimal competition, and has the highest or second highest market share in its specific market segment. When CSU acquires a good company, CSU identifies and addresses the reasons they have not become an exceptional company. CSU will offer coaching and resources in several areas, including establishing values and capital allocation processes, profit-sharing programs, benchmarking against other businesses, the chance to share best practices with other CSU companies, formal management training and ongoing mentoring.

After every acquisition, CSU will conduct a post-acquisition review on the first anniversary of the deal. These reviews come from a belief that investment only becomes a lesson if the company diligently tracks its post-acquisition performant. These reviews will help CSU improve its M&A strategy.

A consequence of acquiring established VMS businesses with dominant market share is that the end market tends to be relatively saturated, which is why CSU organic growth is in the low single digits, but the companies they own produce a large amount of cash which is reinvested by buying new businesses.

In a shareholder letter from 2014, Mark mentioned that as long as a company provides an attractive IRR, irrespective of whether it is associated with high or low organic growth, he would buy the company.

“How about a thought experiment? Assume attractive return opportunities are scarce and that you are an excellent forecaster. For the same price you can purchase a high-profit declining revenue business or a lower profit growing business, both of which you forecast to generate the same attractive after tax IRR. Which would you rather buy? It’s easy to go down the pro and con rabbit hole of the false dichotomy. The answer we’ve settled on (though the debate still rages), is that you make both kinds of investments. The scarcity of attractive return opportunities trumps all other criteria. We care about IRR, irrespective of whether it is associated with high or low organic growth.”

(Source: Constellation Software 2014 shareholder letter)

The company follows Berkshire Hathaway’s decentralized model, as it keeps the old management after acquiring a company. This decentralised model leads to business unit managers focused on pursuing organic growth while operating group managers and head office will focus on acquiring new businesses. The decentralised also encourages sharing ideas between different operating groups.

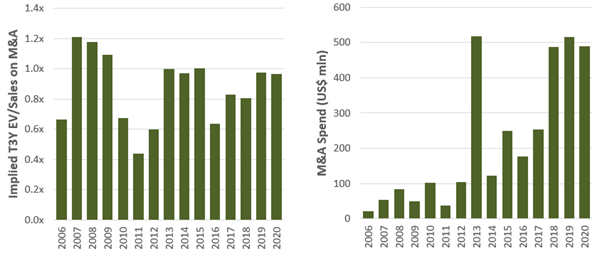

CSU typically acquires companies valued between $1 million and $5 million, paying a 1x revenue multiple. This is because they don't face competition from private equity groups, who are fishing in bigger ponds. CSU, being a small fish in a small pond, focuses on smaller companies. Another reason CSU can purchase companies at a lower price is that, like Berkshire Hathaway, owners prefer to sell to a trustworthy group. Private equity groups don’t tend to be long-term owners of a business, usually, they would sell after a certain number of years to pay off shareholders who want to redeem their capital. If an owner wants to continue his/her legacy, he/she can trust CSU to do it as they will not pass its company around like a game of hot potato. Private equity groups can also become victims of their success. If a group has done well acquiring small companies, then its assets under management (AUM) will grow as more capital is injected into the fund due to its recent outperformance. This means that the private equity group will no longer be able to buy small companies and will need to now buy larger companies. With no competition, CSU can pay a low multiple. As we can see in Chart B, provided by the 10th Man, the multiple that CSU pays for a VMS company has stayed around 1 EV/sale, even though M&A spend has increased.

(Chart B. Source: The 10th man)

As CSU has increased in size over the years, many have expected that the database of the companies they can acquire has shrunk. 2017 was the last year CSU reported the number of companies on its database, which was 40,000. This has grown as Christopher Mayer, Shareholder of CSU and author of 100 Baggers, reported that the company now has over 100,000 companies on their database. The reason for this growth may be because of expanding into other geographical markets such as Asia and South America.

The Compensation Plan

As we can see above, the company believes that shareholder value is created by managing two financial components over the long term: profitability and growth. Unlike other companies, CSU's compensation plan is based on profitability and growth. CSUs employees would need to meet a certain ROIC and growth target. Constellation Software's compensation plan is unique in that it is mainly based on profitability rather than revenue and earnings growth. This is a wise move, as earnings growth can be easily manipulated and may not necessarily create value for shareholders. By focusing on profitability, the company ensures that it is generating sustainable cash flows and creating long-term value for its shareholders. Additionally, the company mandates that if employees have compensation of over $75,000 and bonuses over $10,000, they must use at least 25% of that compensation and bonus to buy company shares. This aligns employees' interests with those of shareholders and encourages them to think like owners. Finally, senior executives are required to invest 75% of their bonus in shares of the company, which further aligns their interests with those of shareholders.

CSU's compensation plan has proven to be highly lucrative. In 2015, Mark reported that over 100 employee shareholders became millionaires as a result of the plan. This number is anticipated to have increased, as the company's stock has consistently outperformed benchmarks like the S&P 500.

Unlike most technology firms, CSU doesn’t do SBC. According to the CFO, one reason for this is to avoid employees solely focusing on increasing the stock price to profit from stock options.

The Future Of CSU

In an economy with high inflation, protecting against the potential loss of real revenue growth is crucial. That's why CSU has implemented an inflation clause, which increases fees charged every year in line with the rate of inflation, as a defence against inflation.

CSU has several growth opportunities, one of which is expanding internationally. The VMS markets outside of North America are largely untapped and fragmented, providing ample room for growth. CSU has already seen success in Europe with Topicus and can explore further possibilities. The company already has a presence in countries such as Pakistan, South Africa and Singapore. As CSU expands into other continents, its investment universe will expand and the deals they complete a year will grow. Deals completed in a year have been growing as the company completed more than 100 deals in 2022 compared to just 50 in 2017.

While higher interest rates and a global economic downturn may negatively impact many companies, CSU can benefit from these conditions. This is because the company can acquire top-quality companies at a lower valuation without taking on additional debt, thanks to its substantial free cash flow. Several CSU competitions, including PE groups, depend on borrowing to carry out transactions. If interest rates increase, it will raise the cost of capital for CSUs' competition, thereby requiring them to seek higher returns. To achieve this, PE groups have to offer lower prices.

Risks

One risk that CSU faces is the possibility of not being able to continuously improve its product. In the fast-paced world of technology, companies that do not allocate enough capital towards research and development (R&D) and capital expenditures (CAPEX) may fall behind.

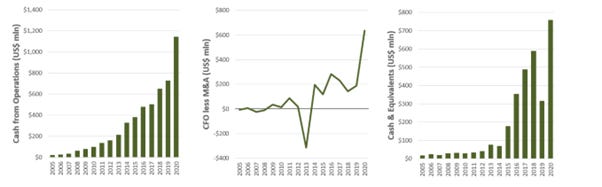

As CSU has grown larger, allocating capital effectively has become more difficult. Chart C, provided by the 10th man, shows that CSU's cash from operation (CFO) less M&A has steadily increased over the years. Additionally, CSU's cash on the balance sheet has also been increasing. This has led the company to pay a special dividend, which Mark Leonard has stated he regrets. CSU currently earns an ROIC in the mid-20s. For a company with a high ROIC, it is better to reinvest cash back into the business rather than pay it out as dividends, as shareholders would find it difficult to earn a return above that.

(Chart C, Source: The 10th man)

Mark released a letter in 2021 that focused on strategies to deploy more cash on M&A activities by lowering CSU's hurdle rate on larger deals (M&A deals worth more than $100 million) and expanding into new industries. CSU will now deploy capital on large companies as long as its ROIC is above its cost of capital. This will boost EPS growth, but it may not be positive for shareholders as ROIC will be lower in the future. To compete with private equity groups and secure bigger deals, the company will need to pay higher multiples (although in a high-interest environment, PE groups may not be competitive as they rely on debt to complete deals). CSU must also be willing to pay a premium to catch the attention of M&A brokers, as in the past 5 years, CSU has only been invited to participate in 16% of the large VMS business deals, despite being aware of 80% of them. To improve their chances, CSU has been building a team at their head office to pursue more large VMS acquisitions. As mentioned above, higher interest rates will help CSU as it will increase the cost of capital for PE groups.

The majority of the capital would still be invested in small and mid-sized VMS businesses. Another good news would be that CSU will not pay a special dividend as it now has a larger investable universe. During the first half of 2023, CSU has been very active in acquiring new businesses and is on track to set a record for the amount of capital they have used.

Focusing on new industries may also be a risk as the company may not have the expertise needed. However, CSU has not yet found a new industry to enter. Mark has said that the likelihood of success in another industry is near zero. The future value of CSU is dependent on its ability to continue making successful acquisitions, as it has done in the past. If the managers fail to do so, the stock price could underperform.

The company may face risks from lower organic growth, which could negatively impact the internal rate of return calculated by Mark Leonard using ROIC and organic growth. According to Marks' 2017 letter, this metric has been in the high 30s. However, transitioning to recurring revenue could positively impact organic growth and ROIC.

Another risk the company faces is Mark Leonard Retiring. This risk may be overblown as Mark doesn’t play a big part in M&A activities because he has given some responsibility to operating group managers and other head office colleagues.

Operating a technology-based business carries a significant amount of risk due to the rapidly evolving nature of technology. While VMS companies have been traditionally difficult to disrupt, the advancements in AI could potentially lead to their disruption. It's challenging to predict the impact of AI on VMS businesses, as AI is still in its early stages of development.

Review Of 2021 and 2022

In 2021, CSU spun off Topicus and Lumine. Lumine is a VMS company that focuses on the travel industry. Topicus is essentially a mini-Constellation software that primarily operates in Europe. CSU may not own more than 50% of Topicus, but it holds a super-voting share, giving it 50% voting power. The company also holds a unique share in Lumine, granting it 50% voting power.

In an AGM, Mark mentioned that he saw the future of CSU as being many of these spinouts. Mark does not anticipate CSU to spin off another operating group, making it highly unlikely. However, he believes that he can spin off certain verticals, similar to what he’s done with Lumine.

2022 was a very good year for the company as it was able to grow its revenue by 30% and net income attributable to shareholders by 65%. This is very impressive operating leverage by the company, although net income did fall by 28% in 2021, while revenue grew by 28%. Although CSU revenue growth has been in the high 20s for the past 20 years, we should be prepared for a period with lower growth. In Q4 2022, there was a 4% growth in organic revenue after adjusting for foreign exchange rates. Additionally, maintenance revenue, after adjusting for foreign exchange rates, performed even better with a 6% growth. This was the 7th consecutive quarter of growth above 5% and the 10th consecutive quarter of positive growth. This indicates that even in challenging circumstances, maintenance revenue remains strong and stable. Excluding Altera, organic growth would be higher. CSU has a track record of excelling during challenging times, as demonstrated during the global financial crisis. Despite the difficult circumstances, CSU managed to increase both its revenue and operating income while also improving its operating margin.

CSU experienced growth in revenue and income, however, its cash flow did not increase due to a shift in its non-cash operating working capital. In 2022, there was a $45 million benefit, but in the same year, it became a $60 million headwind resulting in a difference of $105 million. If this difference did not exist, then cash flow would have grown by 8%. Cash flow is starting to grow at high rates as operating cash flow grew by 17% in Q4.

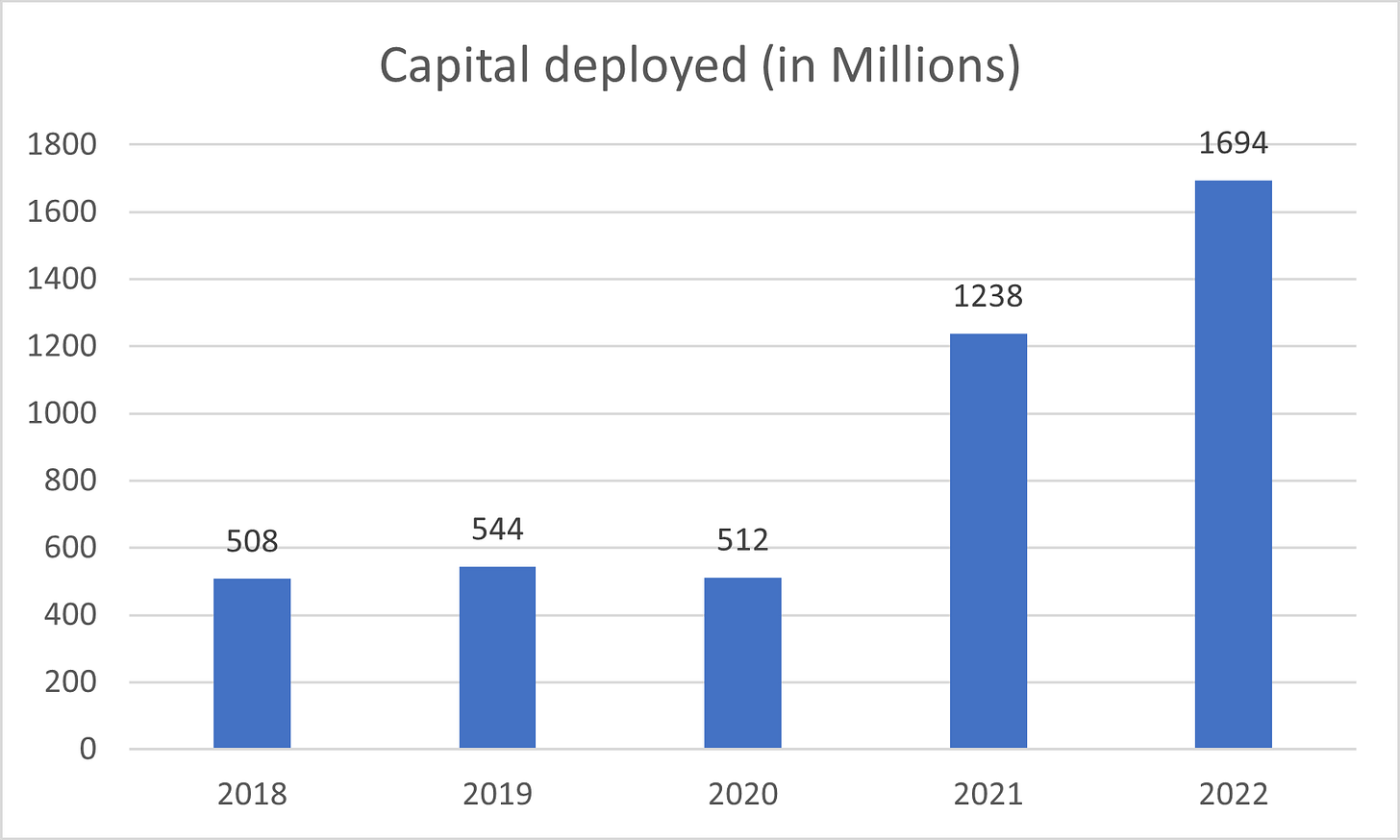

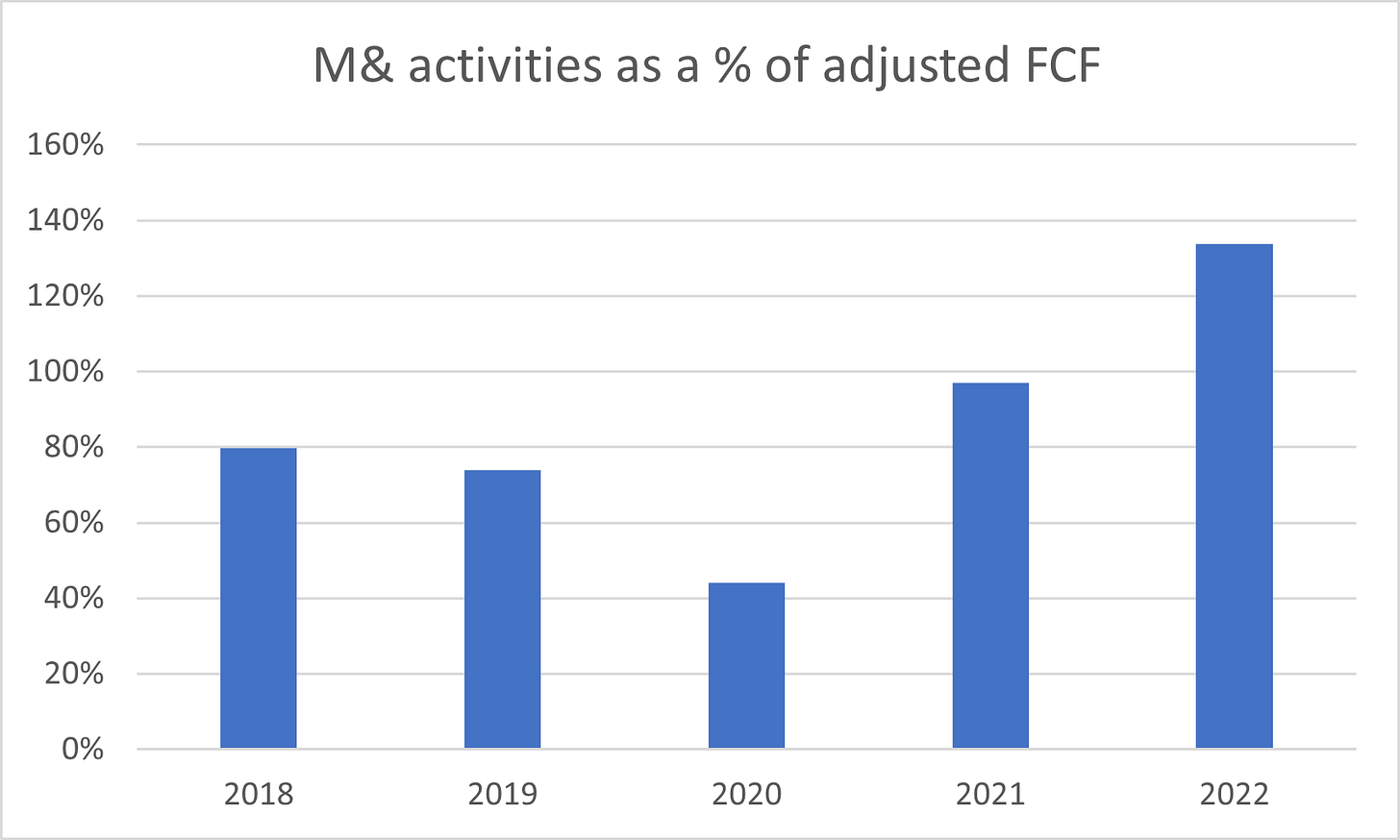

In chart D, we can see that the CSU M&A machine is as strong as it has ever been since Mark Leonard changed its acquisition strategy. In 2022, the company made its largest acquisition in history, paying $700 million for Altera. Altera may be a shrinking asset but if CSU can turn it around, then it can be a great investment. In chart E, we can see M&A activities as a % of adjusted free cash flow, which is calculated as free cash flow – Maintenance CAPEX, has grown from 80% in 2018 to 134% in 2022. The growth in M&A activities has led CSU into taking out more debt, which is highly unusual for the company. Based on Table A, it appears that the company can finance its debt. It can pay off the majority of its debt within a year by utilizing all of its available free cash flow. Additionally, the company can cover its interest expenses 13 times over using its free cash flow. The company also has a credit rating of BBB from Fitch, which is an investment grade rating.

(Chart D, Source: Cash flow statement)

(Chart E, Source: Cash flow statement)

(Table A)

The Quality of the company.

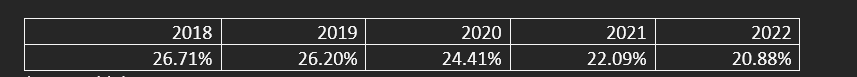

The company generates significant FCF, which is reinvested back into the business by participating in M&A activities. Dividend as a percentage of FCF has averaged 9.93% in the past 5 years. This average should go down in the next 5 years as the company is looking to expand in other industries and has also lowered its internal rate of return (IRR) for larger accusations. ROCE has averaged around 24% in the past 5 years, which is higher than the S&P 500 (according to data from Fundsmith). In the table below, the ROCE has been trending downward in the past 5 years, which may be related to outside factors such as the pandemic and valuations going up. In the future, ROCE may continue trending down, which may not be positive for future returns, as the company lowers its IRR for larger accusations. The global economy entering a recession may be positive for the company as the company could find attractive companies at an attractive price, which means a higher ROCE in the future.

(ROCE Table)

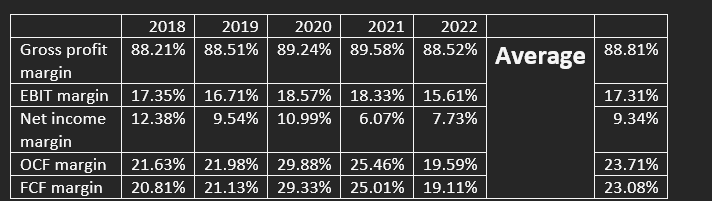

CSU’s 5-year average ROE is 52.58%, Which is incredibly good for any company. This ROE is not boosted by leverage as its 5-year average debt/ free cash flow is 0.87. Looking at CSU margins, the company has incredible margins as shown in Table D.

(Table D)

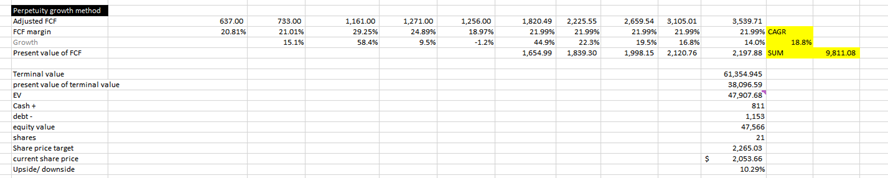

Using a DCF, if we assume revenue to grow at a CAGR of 15.95% and FCF to grow at a CAGR of 18.8% from the year 2022 to 20227, with a WACC of 10% and a terminal growth rate of 4%, the companies fair price in dollars is $2,265, which is higher than the current $2,053 share price.

(DCF)

Based on a reverse DCF analysis, assuming a WACC of 10% and a terminal growth rate of 4%, the market's expectation is for the company to grow its FCF at a compound annual growth rate (CAGR) of 11.35% over the next decade. In my opinion, CSU is capable of achieving this level of FCF growth, indicating that the company is fairly valued. However, if we assume a WACC of 12%, the market is anticipating a higher FCF growth rate of 15% CAGR. Although CSU can attain this level of growth, the probability is low as the laws of numbers come into play as the company expands.

Conclusion

In conclusion, CSU is a high-quality company with exceptional management. Its decentralized model, focused on profitability and growth, has proven to be successful in generating attractive returns for shareholders. The company's unique compensation plan and alignment of interests with employees and executives have contributed to its continued success. Although the company faces risks from competition and the potential for disruption from new technology, CSU's strategy of acquiring high-quality companies has proven to be effective and sustainable. Additionally, the company's expansion into new geographical markets and industries offers opportunities for further growth. Based on my analysis, CSU is currently trading at a fair price, and its future growth prospects make it an attractive long-term investment for investors seeking exposure to the technology sector.